Have you ever thought about how air traffic controllers...

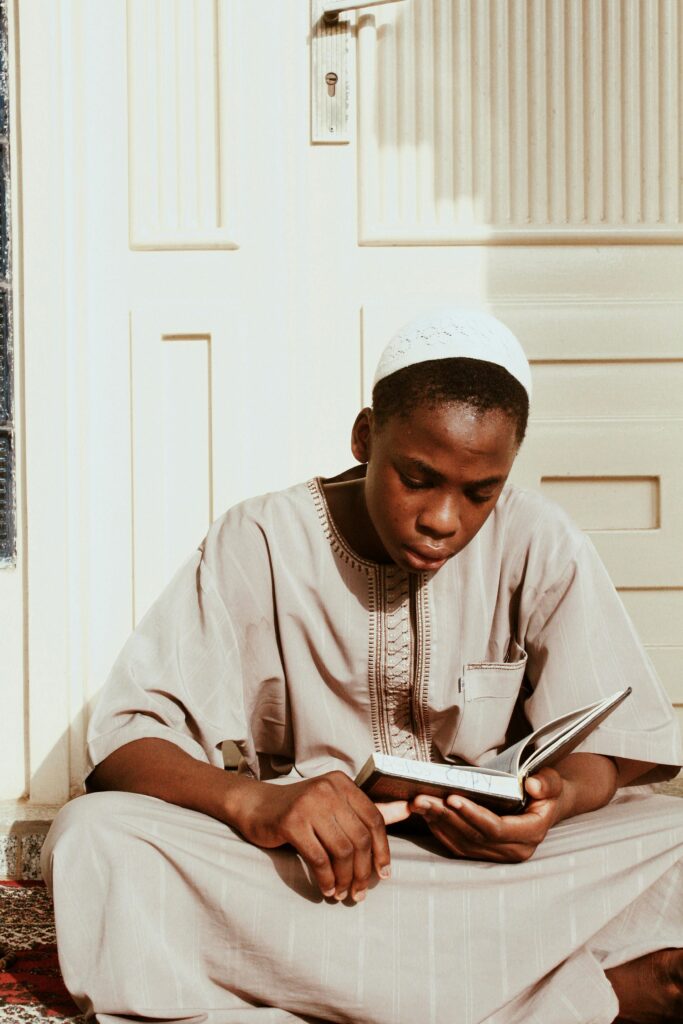

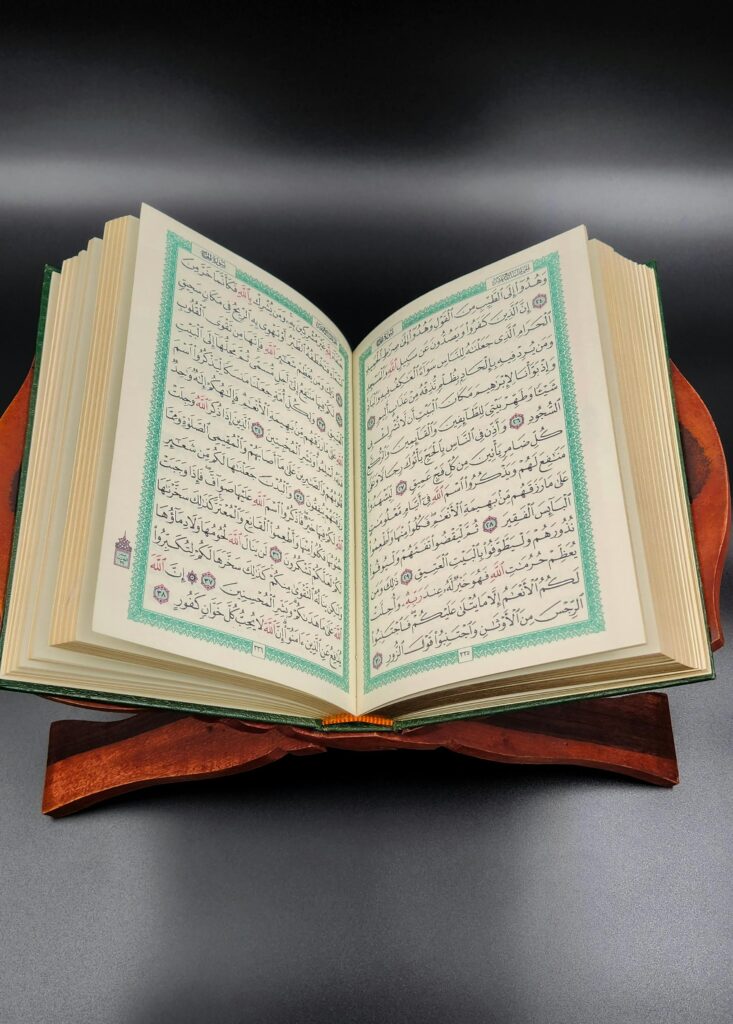

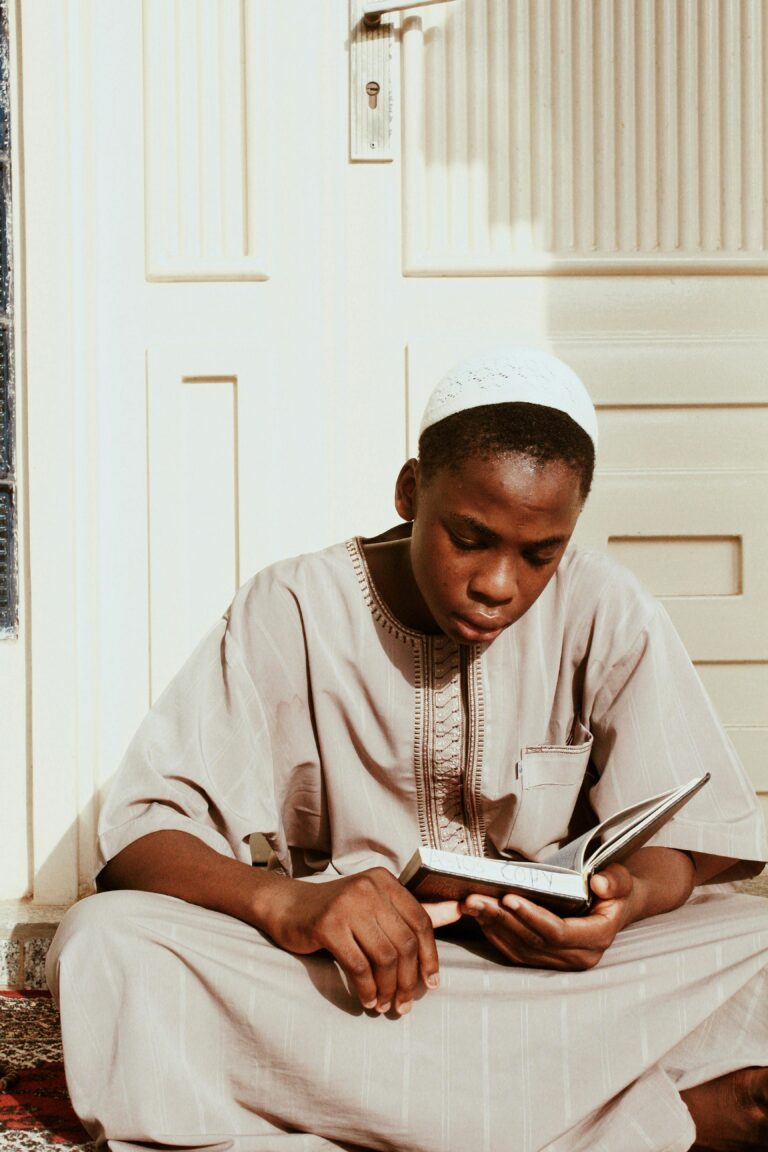

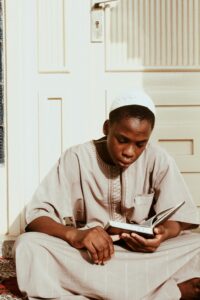

Reciting the Quran is not just a ritual;...

The Quran is not only a book but a...

Teaching Noorani Qaida to kids is an essential step...

Gurgaon, often referred to as the Millennium City, has...

Introduction Imperia Esfera, located in the heart of Sector...

Finding a home that combines luxury, comfort, and convenience...

Gurgaon, also known as Gurugram, has evolved into one...

The gaming world is always buzzing with excitement as...

Picture this: Your business is growing, but your IT...