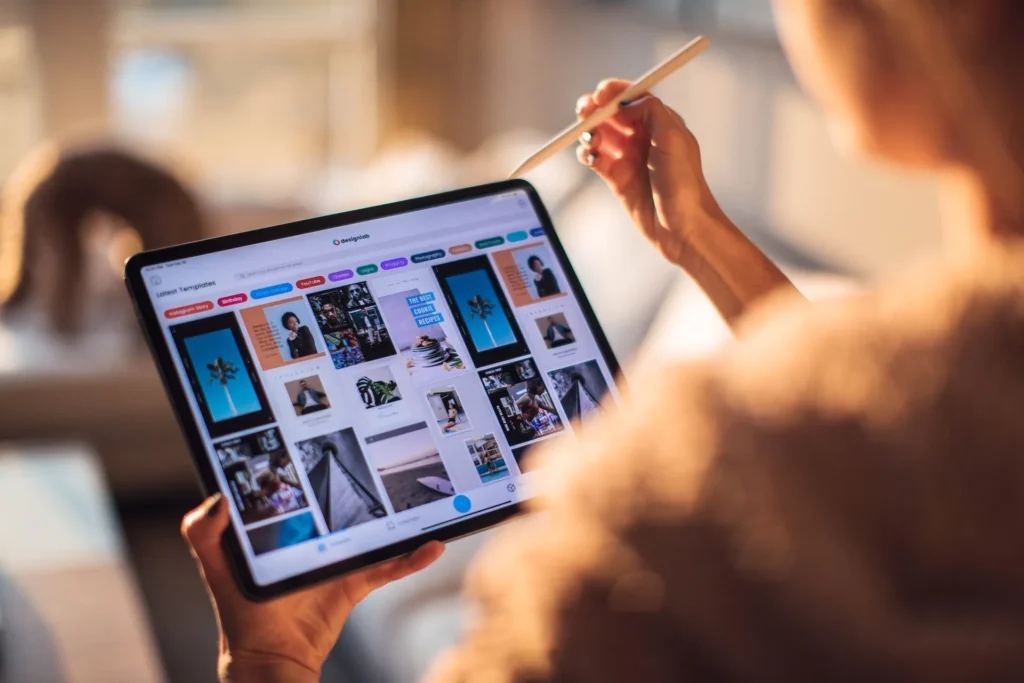

Are you considering using a tablet for design work...

Download E-Brochure :https://bit.ly/3x8LrUu PropertyCloud Project Page: https://propertycloud.in/projects/mum… Godrej Vistas...

AI is becoming a part of our everyday lives,...

Maintaining a lush and vibrant garden requires consistent care...

Don’t get laid by lucrative offers. Do your homework...

Data is everything. As businesses generate more data every...

Choosing the right time to upgrade your server type...

The gaming PCs are the key to unlocking stunning...

When it comes to luxurious living combined with state-of-the-art...

M3M Soulitude Sector 89 Gurgaon: A Premium Residential Haven...